I feel that “outgroup dumb” is shitposting but it’s from a real poll.

https://today.yougov.com/politics/articles/5057-understanding-how-marginal-taxes-work-its-all-part

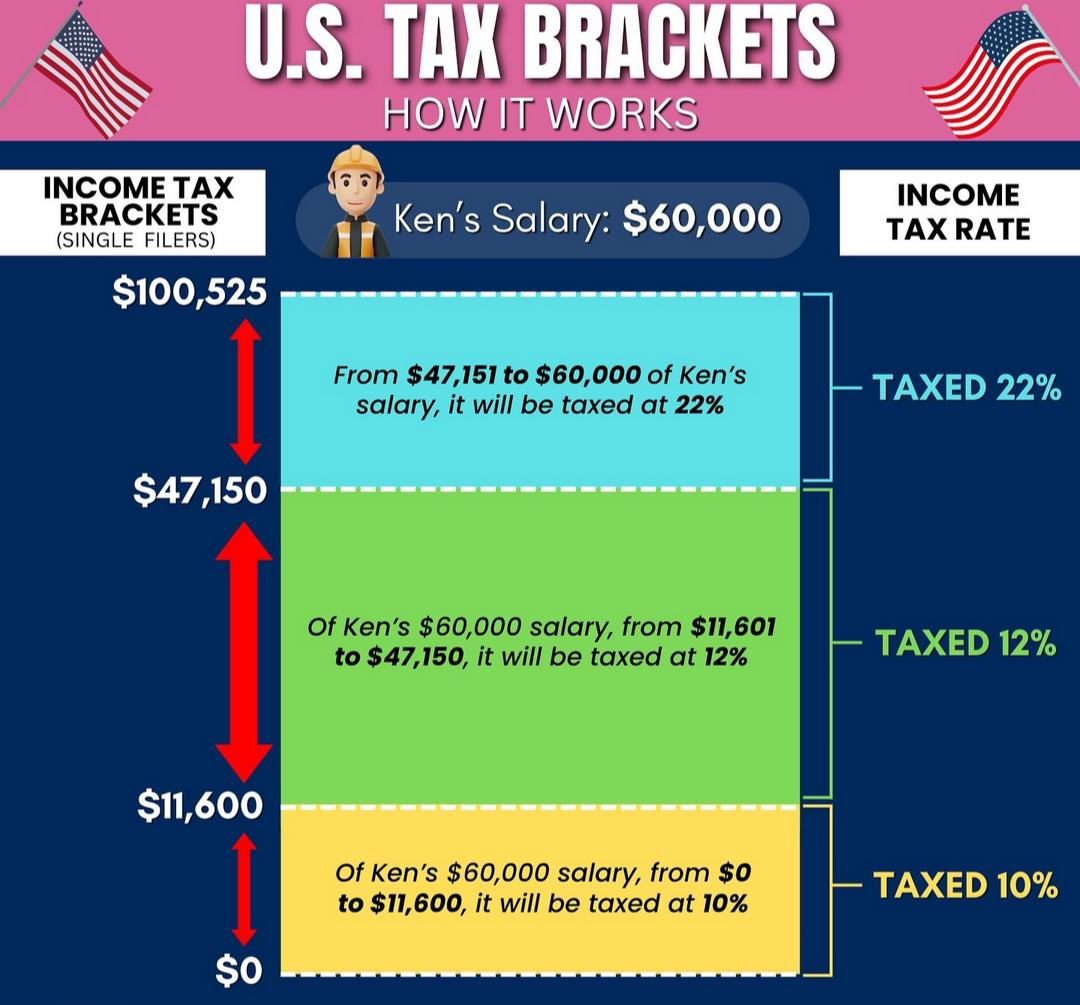

If you ever wanted proof that a population that doesn’t understand math allows the billionaires to take advantage of them here it is. This is why education systems are under attack, because if you understood how taxes work you’d more likely support higher tax rates for the rich.

https://youtube.com/shorts/-621rVJvUdY

Mr. “Population collapse is the biggest threat to the world.”

Maybe it’s just the biggest threat to capitalism and your ROI. Why do you think he’s supporting the make everyone dumber party?

I think this is at least partially the result of intentional propaganda. It benefits the elite greatly if a lot of Americans are screaming against higher top tax rates due to this faulty logic. There are also a lot of anecdotes of people not accepting higher paying job offers or promotions within their company, which also benefits the business owners.

To be clear for those unaware, you pay the lower bracket rates for the amounts earned in that bracket and the higher bracket rates for the amounts earned above that bracket.

https://www.irs.gov/filing/federal-income-tax-rates-and-brackets

This is the problem. My partner doesn’t want to work OT because he thinks it will cost him more in taxes. I explain why that’s not exactly true, but I can tell he’s not interested. Financial Literacy in the US is abysmal.

Tbh, literacy in the US, financial or otherwise is abysmal right now.

By design

No, they teach you this in high school. These people are just dumbasses

Yes, everyone’s education is the same as yours.

I’ve had jobs (more than one), where working OT would result in my paycheck take home pay being less than if I had not worked the extra hours. And that’s because it moved me into the next bracket, and more taxes were taken out. So why waste my time working OT?

That’s not how is works though.

I’d you made say 1500 normally and 2000 with ot your take home could be 1200 and 1400. Paying more taxes overall on the ot but still taking home more.

There is no way you’d take home less money because taxes are paid on the first $1500 @ $300 and say the next $500 @ $300 too at a higher bracket. Overall your pay is still higher though even though your taxes “doubled”.

Well, it has happened more than once. Of course it would depend on the amount of overtime I worked. It probably happened if I only worked a little OT.

That’s not how it works though. Unless you didn’t work regular hours during that same time period so worked less overall OT is taxed higher upfront so you don’t end up owing (more), but would never decrease your pay

But it did, more than once. Its been years since it happened though. I cant remember the amount of OT I worked that caused it.

When you are talking large income to larger income, that makes total sense, but are there limits for access to things like child tax credits where if you go over you are no longer eligible, causing significant increase (I just looked, and it’s at $200k single of $400k jointly, so unless you have A LOT of children, I suppose there wouldn’t be a huge effect)? Similar to people on government assistance who go from getting full assistance to getting nothing at a certain income level?

The big one there is food and housing subsidies. The way way we have it set-up can create a situation where a raise can cost you benefits that are worth more than the raise. With disability benefits there can actually be limits on the amount of money you’re allowed to have in general, which means that disabled people can find themselves in places where not only do they need to avoid trying to find work that they might be able to do, since trying and failing can still make them need to restart the benefits application process or even pay back historical benefits, but they also need to reject gifts above a certain value and can’t prepare for any type of emergency, like a car breakdown.

It’s annoying because it creates a disincentive to do the things that would help people on assistance actually get off of it, when the people who push for those limits purport to want them for exactly that reason.

Tapering off benefits as income grows, but at a slower rate than the income growth creates a continuous incentive for a person on benefits to increase their earned income. (If you lose $500 in benefits for every $1000 in income, your $1000 raise still puts $500 extra in your pocket, instead of potentially costing you your entire $8000 food subsidy)Can’t do that though, because it doesn’t punish people for the audacity of needing help.

This is a big factor. A lot of people conflate less benefits with higher taxes because fear-brain just knows they both equal increased hardship in the end. They’re technically wrong but their statistically slightly more active amygdalas are responding to a genuine threat, just one that they’ve been very skillfully misdirected into helping worsen.

This is absolutely an educational failing. We barely cover taxes in school. At best it’s said once in a class, gets covered in a minor question on a test and if we get it wrong, no one notices. “We” probably still got a B on the test without any CLUE how taxes work.

Yet here we are, dismantling any nationwide effort to make education better.

A LOT of people think 99,999 tax is 27,999 and 100,001 is 29,000, even on the democrat side. If those charts are accurate, it’s probably damn close to 50% of US citizens.

I seriously don’t understand why we don’t have a mandatory class that covers taxes, T4 slips, investing, labour laws, budgeting, reading nutritional information on foods, etc.

I used to be a supervisor at a psych hospital and had to regularly explain this to staff who were refusing overtime. They wanted to do it, sometimes desperately so because they needed the money, but they were utterly convinced that once they crossed 40 or 45k or whatever they would be taxed higher and make it all pointless. I felt like some just didn’t want to do ot, which was fine, but some legit keep meticulous records of their earnings to ensure they wouldn’t go over the line. I swore to them it didn’t work this way but they never believed me

Should print out a poster infographic explaining progressive taxation and put it up on the wall in the break room

Would have to be mandated by workplace regulations, no company is going to voluntarily educate their employees that more money has no downside.

I’ll also say this doesn’t help, it strangely avoids the actual numbers. It should state explicitly that his total taxes would be $1,600+$4,266+$2,827=$8692, and not $13200. Needs to include the scenarios specific results and contrasted with what the viewer would have assumed otherwise.

Yeah I am pretty sure they wouldn’t understand this either

Seen the same bullshit when I worked retail. Nothing will convince them.

It’s easier to trick someone than it is to convince them they’re wrong.

I wonder how different the planet would be if boomers had just been taught, from an early age, that it’s OK to be wrong.

I remember my mom saying something like “don’t believe what you see on tv and only half of what you read.” Yet here we are.

My mom told me “these white people will never see you as an American”

Now she’s blaming democrats for “Migrant crisis”

🤦♂️

Yeah, I remember my parents teaching me a whole lot of shit that Fox News would call “woke” today. I’m just thankful that I grew up when I did, because if it were now I’d probably have died of measles.

No source?