US stocks were sharply lower Friday as investors digested souring consumer sentiment and inflation data that showed an uptick in one of the Federal Reserve’s key gauges, underscoring the delicate state of the economy as businesses brace for President Donald Trump’s tariffs.

The Dow tumbled 750 points, or 1.77%, on Friday. The broader S&P 500 fell 2.1% and the Nasdaq Composite slid 2.8%.

. . .

Wall Street was also grappling with Trump’s announcement on Wednesday of 25% tariffs on all cars shipped into the US, set to go into effect April 3. Trump also announced tariffs on car parts like engines and transmissions, set to take effect “no later than May 3,” according to the proclamation he signed.

Thanks Trump

This is also called a buy phase

Buy low, sell high

Trumps policies are expected to pass costs on to consumers but have the benefit of maintaining production and development internally which should long term keep more money inside the USA, hardening supply lines against foreign influence. Given that China is openly campaigning for war on Taiwan by 2027 latest, and they’re responsible for close to 80% of critical imports to US minerals, this puts the US in a predicament which Trump (probably not on purpose tbh, I won’t give him the credit) is preparing for.

Tariffs on raw metals and minerals have proven effective since his first term with significant improvements in domestic refinement.

-“Tardif pass-through and implications for domestic markets: Evidence from US steel imports” Ahmad et al. (2023).

This isn’t shared by other aspects of the supply network though like finished products or more complicated manufacturing because market instability halts investment in those areas, so no development actually increases in the US and prices just increase. This is a fatal flaw in the tariff calculus that is hurting trade and the economy. Manufacturing takes years to develop and adapt, and no one will leap on that kind of investment without clear assurances.

Thanks trump.

The trump regime was designed to TANK the US economy so that stocks, businesses, and industries can be bought by billionaires at rock bottom prices.

All is going according to plan.

I have an acquaintance that works for an old money, very wealthy family from oil money. The kind that influences regional as well as national politics. He worked for them during the last major recession in the late ‘00s. He basically said that his employer and all their buddies were running all over the world buying everything they could “like it is a fire sale” during the recession.

So yeah. This is how we get more billionaires, more oligarchs, and more meta national corpo monopolies where one company controls multiple brand names.

The best we can do is to quit as soon as your company gets purchased. What they are after is the people. Specially the key role people.

Don’t document your process. Fix things without opening change requests. That way if you assemble things the quality will drop when you leave.

If you’re in a key role, just quit. Don’t go fucking around by deleting data. It’s better to make up data instead that seems real but is not. Never write an email that is personal or has anger in it because, even if you don’t send it, it gets saved. Same for your teams messages. You want to stay in the industry, but just quit if your company gets taken over by a billionaire.

Yeah, almost seems like it. I am convinced they are at least doing something like the “Mar-a-Lago Accord” to devalue the dollar, unseat the USD as the global reserve currency, inflate debt away, and make wages low enough and people desperate enough so more manufacturing is viable in the US again.

Can you define “rock bottom prices”? – asking for a friend.

Buy it with what? Billionaires don’t hold money, their valuation is all in stock value.

I think you’re giving them too much credit. Never attribute to malice that which can be explained by incompetence.

https://www.cbsnews.com/news/billionaire-wealth-covid-pandemic-12-trillion-jeff-bezos-wealth-tax/

Between March 18, 2020, and March 18, 2021, the wealth held by the world’s billionaires jumped from $8.04 trillion to $12.39 trillion, according to the IPS’ analysis of data from Forbes, Bloomberg and Wealth-X. Amazon.com founder Jeff Bezos, the world’s wealthiest person, saw his fortune soar to $178 billion from $113 billion, or 57%, during that time, the study found. All told, the total wealth of the world’s billionaire class grew 54% during the pandemic year, IPS reported.

Lol billionaires absolutely have cash too.

It’s beneficial to keep most of it in stocks, sure, but they also get dividends, which can be used to buy more assets, or kept in waiting for a market downturn to buy even more assets.

The billionaires don’t pay for their supercars, luxury mansion, security details, cesspool social media sites, and private jets with stocks my man. They have plenty of liquidity to go around.

False. They take out special loans only available to billionaires at less than 1% interest. They use their stock as collateral. They never pay back these loans because they don’t want to sell their stock and pay taxes in order to repay them. The banks don’t mind because they know they’re good for it. They keep doing this over and over. Their long term plan is when they die their estate will pay off their debt. That’s the recipe they use to pay zero taxes.

I told my partner that we needed to stop excessive spending like going out to eat while the economy is so uncertain. She was ok with that. I’m not feeling great about our (collective) future. Sigh.

I hate that going for a meal out is considered excessive, from someone who is in the same boat as you.

And all restaurant owners are probably bracing for this to hit hard.

I find it deeply funny that fascism is completely compatible with capitalism (it’s arguably its end-state), but they’re still tanking the economy because Trump doesn’t understand tariffs.

Fascism ultimately tanks any system because it prices loyalty above all else and you inevitably end up without any compitent people in charge.

Yeah, for sure, fascist regimes have a pretty short shelf-life in general because of cronyism and incompetence. I’m just saying there’s nothing inherent to fascism that should be tanking the economy right now in the way, say, a communist revolution would by causing capital flight. If he wasn’t pushing the worst, most unnecessary trade war in history, Trump could have a strong economy right now.

They understand tariffs. They want stock prices to tank so they can rake in on slashed prices. This is just more and more of the same wealth transfer in the past 45 years, just so in our faces that people don’t want to believe it’s happening.

I think that’s true for some of them, mostly the Wall Street folks who have enough diversified wealth to buy a lot of stock during the crash and wait it out. But I think the start-up folks, who’s companies have often never been profitable, and rely entirely on investors over-inflating their value to survive, are freaking the fuck out right now. And I think Trump is just legitimately dumb, doesn’t understand that a trade deficit doesn’t mean America is losing money, and genuinely doesn’t understand tariffs.

So much winning.

Billionaires and corporations are absolutely winning, in the foreseeable future.

While yes, the stock market going down is the opposite of “corporations winning”

the pie is getting smaller but the oligarchs are getting bigger slices.

If you bet on falling stock prices you can still get richer. Especially if you do not give a fuck about what companies you bet on. Or workers. Or society.

Wake me up when it’s worse than 2022.

Hope you like short naps

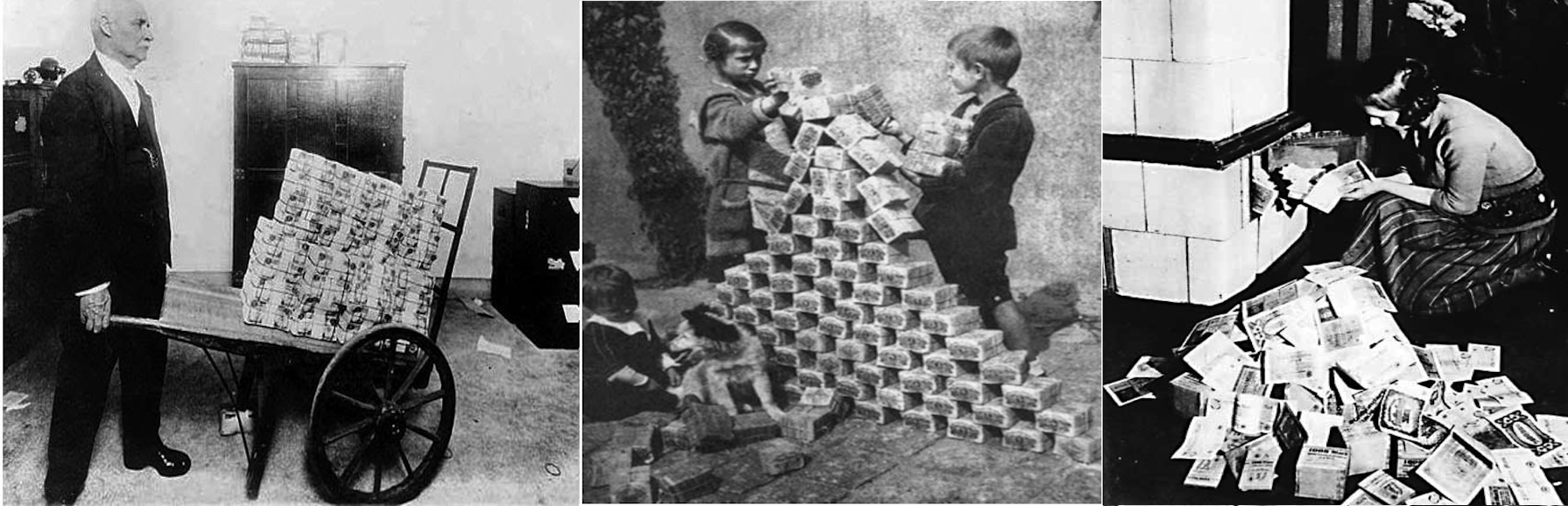

Personally, I am guessing that the American Dollar will end up like the Weimer Republic’s currencies.

I am removing my life savings from the bank and turning them into Euros. Everyone’s economy will dip, but I am pretty certain America will have a Greater Depression. Unlike the Great Depression or the Weimer Republic, the annihilation of government agencies and fiscal instruments is deliberate & total.

I’ve moved most of my savings to Gold since around 2010 partly because I was in the Finance Industry during the financial crash of 2008 and saw how the “fixes” done back then weren’t at all fixing the problems, just kicking the ball forward on the backs of people whose income mainly comes from work (hence the growth of inequality, slow down in social mobility and insane various bubbles including realestate that kept on getting inflated for the last decade) something which has been fueling the growth of the far right (people are feeling the pain, getting pissed of and lots of money has been put by very rich people into political entities and the newsmedia to spread the idea that it’s outsiders who are to blame for all this rather than very wealthy insiders plundering an economy which has ground down to a halt its growth, in collusion with local politicians).

I was also in the Tech Industry during the tech crash of 99, which probably made me even less trusting in the current system’s long term stability.

Gold is a pretty old fashioned way to try and retain some value on one’s savings, especially in countries where government management of the Economy and the local currency is pretty bad (in my own country of Portugal it used to be pretty popular to get it in the form of jewelry for that purpose, though not anymore, and it apparently still is in India and most of Asia including China).

(Basically, it’s the “oh shit” option for when the Economic situation gets very bad and people fear the value of state issued currencies themselves won’t hold)

I can tell you that even though Gold has been mostly just kept up with inflation for the last decade and a half (with an uptick when Russia invaded Ukrained), Donald Trump’s actions really made the value of Gold in most currencies (especially USD) take off like a rocket, or in other words, that the value of most currencies is falling hard compared to what up to 71 was treated worldwide as the reference “currency”.

IMHO, it’s a pretty fucked up sign, especially for the US Dollar (which has the extra nasty bit that it stops being the World’s Reserve Currency, all the benefits from it will unwind and if that happens fast - within a year or two - we might see shit like hyperinflation in the US).

PS: And if I may gloat a bit, I was living in Britain back when Brexit happened and did call it successfully and saved my savings by having most of them in Gold and Euros when Brexit crashed the British Pound by about 30% vs the Euro, something it never really recovered from. Maybe I was lucky but I remember that at the time and even before the Leave Referendum I felt that the Austerity in Britain was stretching the political environment in the country and that it wasn’t a safe place to hold my savings, even though back then all my income was in GBP.

I was in the Finance Industry during the financial crash of 2008

I was also in the Tech Industry during the tech crash of 99

I was living in Britain back when Brexit happened

Your life reads like the lyrics of Sympathy for the Devil.

Well, I guess it’s one way in which one can have “life experience”.

Had I’ve been given a choice, I would have preferred other options.

We need to find where this motherfucker loves and stay away from there.

I’m Portugal now, so with the luck I have an American invasion of Europe will land here within the next couple of years.

Not a bad idea. It’s much easier for one country to fail than a coalition of countries.

We also believe the dynamic macro environment has contributed to a more cautious consumer

Am I getting this right? Is this double speak for “the government is fucking up so badly, people try to save some wealth for the inevitable fall of society”?

I think that is what the main point is. Brace for extremely hard times.

I look forward to mainstream media using real words with real meaning, again.

Meanwhile, the CAC40…

Its almost like it can’t forever be going up…

Almost like someone actively causing instability with bad economic policy and stirring global political instability would cause it to go down.

Except if you follow very basic economic policy and buy low/sell high a recession/major correction is just a buying opportunity. Think new game+ mode, now you extra stonks on your new playthrough.

Clarification: I’m talking about banks causing collapses as a way to consolidate. Not wallstreetbets shit.

Investor bros always pull this line out.

The stock market is more than 30 year olds who can put a extra 100k into it and wait.

A lot of people’s 401ks are tied to this shit, jobs are tied to the market, investments are tied to the market.

It’s a lot more complex than “buy the dip bro!”

Lol I’m not talking about you or i. I’m talking about JP Morgan. I’m talking about Wells Fargo. I’m talking about houses being foreclosed and taken as commercial revenue.

But… But line. Line go up.

Youre telling me that exploiting the workers, making life horrible and expensive for the middle and lower class while giving tax breaks to the ultra wealthy makes the line not go up?

B… But line. Line go up!

With all this hysteria going around it seems like the general population has forgotten how we live in the real world and where we came from, how we got here.

11 weeks ago, ‘2023’ was last year.

This isn’t a slump yet. If Dougie shuts off the power to three states, I hope he does it during a break between the “oh no unregulated drinking water had maaaaaaaassive e.coli in it” diarrhea outbreak right when the softwood tariffs have cratered the toilet paper supply the worst.

At that point in time, expect a stark realization of the state of things to cause some sadness to leak into the market too. I predict three northern states fighting for black market TP and shitting prolifically in the dark to really affect the market. But probably, still, not his numbers.

this isnt a slump yet

Technically we are in correction territory, so id say we are a slump. This isnt the bottom though. Get some puts and ride this baby all the way down. I hit 10x on tesla puts that i bought yesterday. This markets dumb and with the volatility this high, everyone should be making money if they sell when they are green and done diamond hand it

I love this idea that while 60% of the country is living paycheck to paycheck “everyone should be making money” like everyone has money to invest. We are well and truly fucked

From a Canadian masterpiece of a videogame:

Like all of you, I was born poor, with but a meager derivatives portfolio and limited vesting options.

What game?

Warframe

Starts out with space ninja stuff, and progressively gets weirder. Currently it’s the time travel zombie boyband clone hunting story arc. Still with space ninjas though.

What game?

I turned $70 into $2k in the last 2 days. It doesnt take much to get started

No offense but that sounds like casino talk. You got lucky. You definitely should not be telling people to invest in things they don’t understand with money they don’t have.

Yeah gonna back you on this one, maybe I’m I’ve got a bit too much Scottish blood but the risks involved in it are too high and reliant on an inmate volatility. If ya have the extra cash to spare get a good pair of boots, tools, or equipment which are good investments the difference between a yearly replacement and a bi yearly replacement may very well be 30 bucks.

Also yes I am paraphrasing Sir Terry Pratchett.

Sure, but you see tesla going up on bad news, its not difficult to anticipate its going to come right back down. Im not telling people to throw money away, obviously you need to be educated. Last year i turned 7k into 35k. Took it all out except 700 and am already back to 6k.

Ive been doing this for about 14 years. I have experience and knowledge that someone starting out doesnt. That wasnt my point. My point is, it doesnt take much money to get started.

right when the softwood tariffs have cratered the toilet paper supply the worst

Time to invest in bidets.

Or just wipe your arse on the curtains.

deleted by creator

…what year do you think it is now?

Edit: i mistook their comma for a semicolon

Based on their comment, 2025.

It’s gotta be at least 2027 by now…

Looks like I made the right choice pulling most of my 401k out of stock/blended funds and into stable bonds.

Looks like I made the right choice by not saving money at all and working until I die.

Looks like I picked the wrong week to quit sniffing glue

At least you don’t have a drinking problem

No problem!

These are the type of comments I came to read on Lemmy.

It’s going well with the ‘Make America Great Again’ over the other side of the pond

Looks like I picked the wrong week to quit amphetamines

Bro just quit buying avocado toast and pull yourself up by them bootstraps, you’re just not working hard enough bro get on the grind and then you can maybe retire in a slightly larger cardboard box

Maybe even be able to afford the ritzier corrugated cardboard boxes everyone’s talking about?

Looks like I made the right choice pulling most of my 401k out of stock/blended funds and into stable bonds.

You’ve made HALF the right choice. You “sold high”, which is great!

However, the harder part is knowing when to go back in for the “buy low” part. If you’re out of the market when that recovery occurs you’ll be missing out on those gains. I’ve look at historical recoveries and can tell there is no way I’ll know when that time is. I will guess wrong every time.

I hope you’re better at it than I am.

Most people arent playing the market daily. Especially in something like a 401k. You dont need to time the bottom. We’re already in a correction, and its still going. You can wait until the market recovers, and as long as you buy back at a price lower than what you sold, call it a win.

Dont chase, “what could have been” because youll always feel like you lost

You can wait until the market recovers, and as long as you buy back at a price lower than what you sold, call it a win.

Right, thats the magic, but its not that easy. No one knows when that will occur.

You have to accurately predict both a high enough point to profit, but also, and much harder, put the money back in when you decide its “low enough”. Look at historical recoveries. You said it yourself, most people aren’t playing the market daily. The folks that are pulling out may miss the recovery by weeks or more because they’re not watching. I know I don’t watch that closely, but I also don’t try to time the market.

Dont chase, “what could have been” because youll always feel like you lost

Isn’t that what trying to time the market is doing? The folks that are pulling out to put in later are attempting to time the market.

I’m arguing the opposite. “Time in the market beats timing the market.”

We have a lot of the same points, but what im trying to drive home is that, “buy low, sell high,” doesnt mean, “buy the lowest, sell the peak.” Markets in correction right now, its generally trending down. Potentially will turn bear market. You dont need to follow daily to know that. Now is as good a time to sell as last week, or the peak. You didnt miss it.

When it goes down more, you dont need to see the bottom. You can wait until it hits recovery or bull market even, and buy back. That point will likely be lower than where you sold even if its not the lowest. You dont need to buy the bottom, but buying lower than you sold is a win.

I agree, especially since interest rates are currently relatively high, it’s quite OK to remain liquid these days.

When it goes down more, you dont need to see the bottom.

So when are you recommending buying back in with your strategy? 1 point lower than you sold for? 10? 100? 1000?

You can wait until it hits recovery or bull market even, and buy back. That point will likely be lower than where you sold even if its not the lowest. You dont need to buy the bottom, but buying lower than you sold is a win.

Unless you miss that point, and you have to buy back in higher than you sold for, and it could be years before its ever low enough for you to “buy back in low than you sold”.

If you buy back in when its higher than your arbitrary threshold, but then drops back down again the next day, do you sell again?

I went almost 100% cash recently. I’m waiting for another 10% decline in the sp500. Then reassessing. Probably start buying back gradually.

Never thought I’d time the market with this much of my money. In ‘07, I didn’t sell. I shoveled as much as I could into that furnace. This time truly is different, though. The prez works for a foreign adversary.

I wish you luck. This is the fourth huge stock selloff in my lifetime, and for none of them did I accurately predict the recovery.

when we hit recovery or bull market

Those are technical terms. Thats when i recommend buying back in.

Those are only defined for a time period historically. When those time periods have those names, you’re at the point I’m talking about where you may have missed the entry point to buy in cheaply. Nobody says, with any faith or knowledge, “this is it! this is the recovery starting right now!”.

Timing the exact top and bottom is impossible, but you can always sell at an all-time high and buy at a 52 week low.

Personally, I find it more effective for myself if I frame it in terms of “owning the most shares” instead of “making the most dollars”.

If I started with 100 shares and now have 200 shares, I consider that a win, even if the 200 shares together are worth less than the 100 shares were at one time.

Timing the exact top and bottom is impossible, but you can always sell at an all-time high

An all-time high? So on point over the prior record and you sell?

and buy at a 52 week low.

I’m not understanding your strategy here. What are you accomplishing by putting your money back into the market at the dollar figure equal to the lowest value in the last year (52 weeks)? Especially if you sold at one point over the prior record (the all time high) you could be out of the market for years while stocks are on a rapid increase. The last 2 years of the S&P500 were both north of 23% returns back to back. Using your method you would have sold sometime in 2022 losing all those HUGE gains.

What if the recover occurs prior to stocks ever hitting the 52 week low? You’d still be out of the market and will have missed the recovery.

Personally, I find it more effective for myself if I frame it in terms of “owning the most shares” instead of “making the most dollars”.

If I started with 100 shares and now have 200 shares, I consider that a win, even if the 200 shares together are worth less than the 100 shares were at one time.

This confuses me even more. Number of shares is completely irrelevant. Stock splits double shares (and half values), a reverse stock split would double value (but half number of shares). I mean, if you’re just interested in number of shares, you do you, but most people use stocks as an investment vehicle where the value of those stocks is primary value (voting rights being a second value but most people don’t care about that).

If you can’t even understand that I am obviously not including things like stock splits, then I don’t think my comment was intended for you.

If you’re holding the opinion that simply the number of shares of something is more important that the total value of dollars those shares represent, I’m not sure who your audience is for your comment to be intended for.

My audience is people who are literate. You’re just reading stuff into my comments that a reasonable person wouldn’t.

And that’s fine, you do your investment strategy. I’m happy with mine.

Go back and read our exchange. You wrote your position. I communicated my confusion with what I read of your position. You’ve done nothing to explain further what is wrong with how I explained how I understood your position except to say essentially “not that way”. You have yet to provide any more information for me to understand what your way actually is.

I’m not upset with you or your position, I’m genuinely confused. I’m happy to be corrected with my understanding of your position, but you’ve offered none. How else am I supposed to understand you? Just guess more and have you tell me “not that way” more? If you don’t want to talk about it more, thats fine too. I hope you have a great day.

deleted by creator

You can never time the lowest point. What you can do however is guarantee yourself a massive gain over the next few years when the stocks inevitably go back to pre-trump levels by buying it now, which is already much lower than it was 2 months ago

Wait 16 months.

It’s gonna go lower before it’s done, but at 18 months people will know how the midterms look, and the next chance to break this 3/3 lock on government by the aristocracy.

Then it’s either dump it back in or dump it in the Nikkei or something as you negotiate the sale of the smoking ruin you called a house and get on the boat.

You can never time the lowest point.

You’re cheating this exercise. We were talking about properly guessing when to buy back into the market, and you’ve predicated your solution with this:

What you can do however is guarantee yourself a massive gain over the next few years when the stocks inevitably go back to pre-trump levels by buying it now

This presupposes you’ve already sold to a cash position prior to the fall. So that would be accurately timing the market at the best time to sell off. If you sold even a month ago, you would have already incurred a loss from the highest peak value. You’re arguing against the parent post about selling off all stocks to a cash/bond position today. You’re both depending on a close-to-perfect timing of the market. He’s depending on buying in at the low, you’re depended on knowing when the high was to sell.

Also, I think its sound thinking to always be suspicious of anyone’s claim saying “What you can do however is guarantee yourself a massive gain” when talking about investments. There is no such thing as a guarantee in investing.

The right time to go back in is whenever this admin is done, there is no “low” when the floor keeps falling out.

That sounds like a rational answer. Stock markets are not rational. Also, who’s to say the next admin isn’t just a carbon copy of this one?

That’s great, until our money is worthless and hyper inflation sets in. Nothing will keep your money safe from that.

That is a good point. I think Turkey is a good example of that happening right now. I don’t know that they are technically an example of hyperinflation, but they have had extremely high inflation.

About Jan 21st, I moved 50% to “international developed market”, there is 0 stock from USA in the fund.

Depends when you’re going to need that money. If it’s decades in the future, then reacting to market fluctuations like this only tend to make people lose money on the long run. There’s yet to be a stockmarket dip that we haven’t recovered from.

deleted by creator

Thanks trump. (if he can take credit for Biden’s economy then he can take credit for his ineptitude too)

This isn’t because of Bidens ineptitude though. This is entirely Trump’s fault. Anyone with half a brain could predict this after attacking our allies and bringing up the tariffs.

If he can take credit for the past admin, he can take credit for his failures.

He won’t, Trump can do no wrong according to himself and his cult followers. Anything good is all him, anything bad is a nebulous thing he had no part of.

The tarrifs are 100% donnie.

Honestly, kinda surprised it is only dropping this much. Would have though the collapse of the free world as we know it to have more of an impact.

(extremely reddit voice) priced in

Damn it, who is buying the dip?

I mean, technically most people with 401ks are buying the dip.